Introduction

The PaySense Partner App is a game-changer for individuals and businesses looking to offer financing options to their customers. With already over 1,000,000 users benefiting from PaySense personal loans, this app is at the forefront of providing financial assistance for a variety of needs. Whether it's a medical emergency, education expenses, wedding costs, or even just upgrading to new electronics, PaySense has got you covered. The best part? No bureau score or credit card is required, making it accessible to all. With instant loans ranging from ₹5000 to ₹500,000, at competitive interest rates and processing fees, PaySense is the go-to solution for anyone in need.

Features of PaySense Partner:

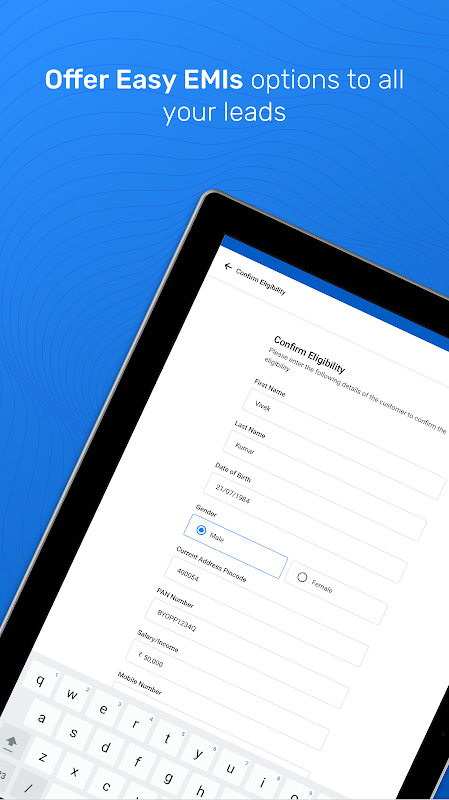

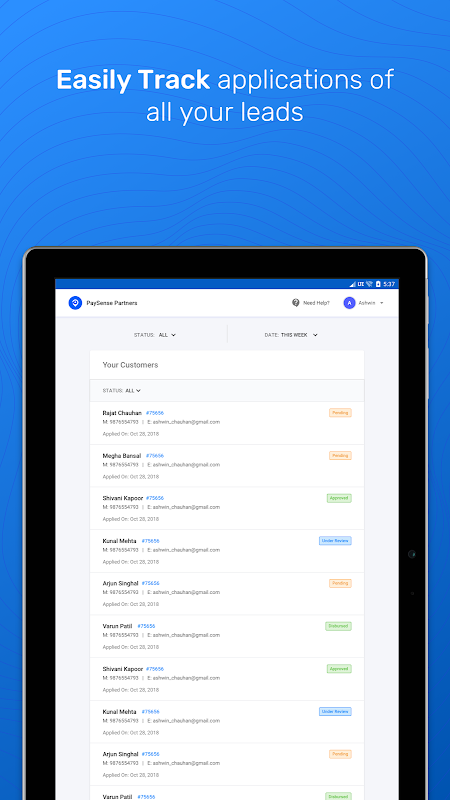

> Quick and Easy: The app offers a quick and easy way for partners to help their customers secure personal loans or financing options. With just a few simple steps, partners can guide their customers through the loan application process, saving them time and effort.

> Wide Range of Loan Purposes: PaySense has already helped over 1,000,000 users with personal loans for a wide range of purposes, from medical emergencies to education expenses, from wedding costs to purchasing two-wheelers. Whatever the need, PaySense is there to provide financial assistance.

> No Credit Card or Bureau Score Needed: Unlike traditional loan providers, PaySense does not require customers to have a credit card or a high bureau score. This opens up opportunities for individuals who may have limited credit history or have faced financial challenges in the past.

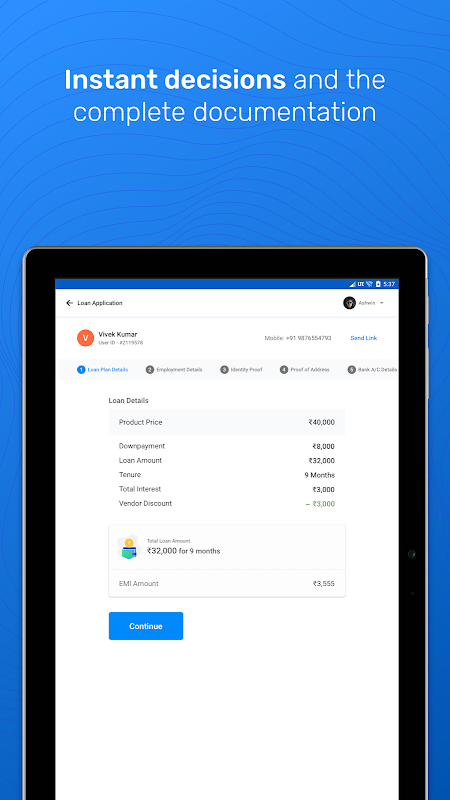

> Flexible Loan Amounts and Durations: PaySense offers personal loans ranging from ₹5000 to ₹500,000. Customers can choose the loan amount that suits their needs and repayment capacity. Additionally, the duration of the loan can be adjusted from 3 months to 60 months, providing flexibility in managing repayments.

FAQs:

> How long does it take to get a loan approved?

The approval process is quick, and customers can receive instant approval within minutes of submitting the necessary documents and information through the PaySense Partner App.

> What documents are required for loan application?

Customers need to provide basic KYC documents such as Aadhaar card, PAN card, and bank statements. Additionally, proof of income or employment may be required depending on the customer's profile.

> Can self-employed individuals apply for a loan?

Yes, PaySense serves both salaried and self-employed customers. Self-employed individuals just need to provide additional documentation such as business proof and income tax returns.

Conclusion:

With a wide range of loan amounts and durations, flexible approval criteria, and quick processing times, PaySense stands out as a convenient and efficient financing solution. Whether for medical emergencies or purchasing big-ticket items, PaySense is dedicated to helping individuals achieve their financial goals. Start using the PaySense Partner App today to unlock the potential of helping your customers access the funding they need.

- No virus

- No advertising

- User protection

Information

- File size: 15.20 M

- Language: English

- Latest Version: 1.0.20

- Requirements: Android

- Votes: 256

- Package ID: com.gopaysense.android.boost.partner

- Developer: PaySense Pte. Ltd.

Screenshots

Explore More

We have compiled a selection of reliable and user-friendly mobile learning and educational apps for 2024. These apps offer rich learning materials and diverse course offerings, allowing users to select courses based on their individual needs. Check them out if you're interested!

Video Downloader

HelperPlace - Job for Helpers

Translator for All Languages

meditatorium

Biografi & Kisah Nabi Khidir

HiEdu Scientific Calculator

Promova: Fast Learn Education

MEGOGO: Live TV & movies