Scan to Download

Introduction

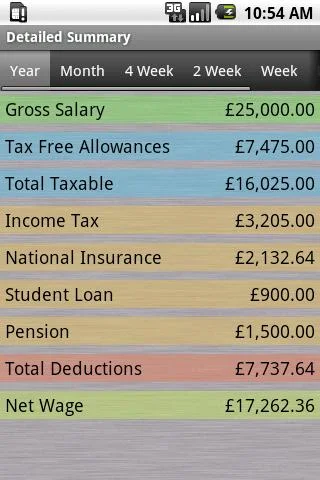

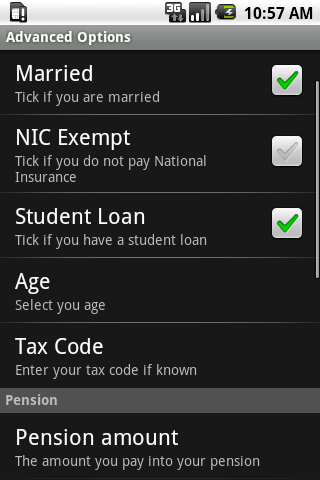

Introducing the ultimate tax assistant: the PAYE Tax Calculator app! Designed exclusively for users in the UK, this incredible tool takes the hassle out of calculating your income tax, national insurance tax, student loan, and pension contributions. Whether you're on a regular salary or benefiting from the government's job retention scheme, the app's latest update even allows you to calculate your net pay while on furlough. With support for SMART, employer, and private pensions, as well as child care vouchers, this app has got you covered. Get a detailed breakdown of your tax bands with just a click. Say goodbye to tax-related headaches and let the app crunch the numbers for you!

Features of PAYE Tax Calculator:

❤ Accurate Tax Calculation: PAYE Tax Calculator is a reliable tool that accurately calculates the amount of Income Tax, National Insurance (NI) Tax, Student Loan, and Pension you should be paying for your salary. This ensures that you have a clear understanding of your financial obligations to avoid any potential surprises or underpayment.

❤ Updated for Furlough Income: With the recent introduction of the government's job retention scheme, PAYE Tax Calculator has been updated to calculate net pay specifically for individuals on furlough. This feature ensures that you remain up-to-date with the latest changes in the UK tax system and have an accurate reflection of your income.

❤ Comprehensive Support: The app provides comprehensive support for various financial aspects, including SMART (Salary Sacrifice), Employer, and Private pensions. Additionally, it also covers Child Care Vouchers, ensuring that you have a holistic view of your tax obligations and potential savings opportunities.

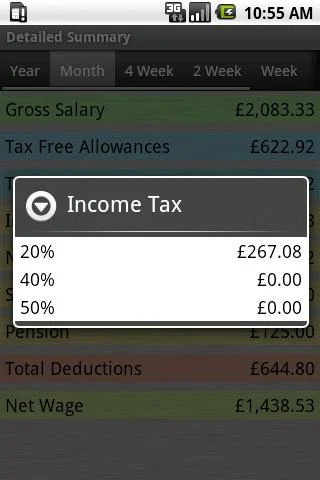

❤ Detailed Tax Bands: PAYE Tax Calculator offers the option to view a breakdown of your tax results by clicking on the tax summary. This feature allows you to understand how your tax liability is distributed across different tax bands, providing valuable insights into your financial situation and aiding in effective financial planning.

Tips for Users:

❤ Input Accurate Information: To ensure accurate tax calculations, it is essential to input precise information regarding your salary, pension contributions, and any other relevant financial details. Double-checking the accuracy of the data will help you obtain the most reliable results and avoid any discrepancies.

❤ Stay Informed about Tax Updates: Given the ever-changing nature of the UK tax system, it is crucial to stay informed about any updates or changes that may affect your tax calculations. Keep yourself updated on regulations related to furlough, pension schemes, and any other relevant financial aspects to ensure accurate tax calculations.

❤ Utilize Detailed Tax Bands: Take advantage of the feature that allows you to view a breakdown of your tax results by tax bands. This will help you understand how your income tax is distributed and identify any opportunities for tax optimization or potential areas where adjustments could be made to enhance your financial situation.

Conclusion:

With its accuracy in tax calculations, comprehensive support for various financial aspects, and updated functionality for furlough income, PAYE Tax Calculator provides users with the necessary tools for informed financial planning. By following the playing tips and utilizing the detailed tax bands feature, users can make the most of this app and have a clear understanding of their tax obligations while optimizing their financial situation. Don't miss out on downloading this essential tool for managing your taxes effectively.

File size: 4.60 M Latest Version: 1.24.3

Requirements: Android Language: English

Votes: 202 Package ID: com.roblovelock.payefree

Developer: RL Software

Screenshots

Explore More

Discover and download the latest system software of 2024 at high speed for free. Explore multidimensional rankings and references to help you choose the best system software. Rest assured, all software has undergone rigorous security checks and virus scans for your safety.

Popular Apps

-

2

PS2X Emulator Ultimate PS2

-

3

Controls Android 14 Style

-

4

Slotomania

-

5

Jackpot Friends Slots Casino

-

6

Klompencapir Game Kuis Trivia

-

7

Know-it-all - A Guessing Game

-

8

A Growing Adventure: The Expanding Alchemist

-

9

Justice and Tribulation

-

10

Toothpick