Introduction

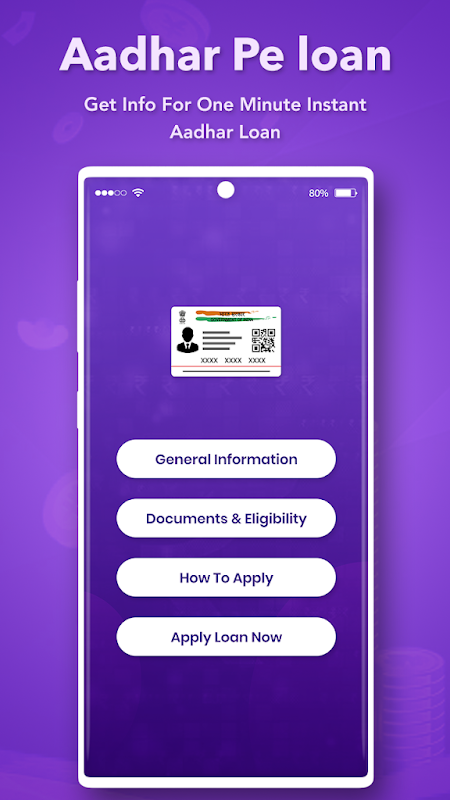

Introducing Get Loan on Aadhar Card Guide, your ultimate solution for obtaining loans with minimal documentation. Whether you need a personal loan, home loan, education loan, credit card loan, business loan, gold loan, or even a car or bike loan, this app has got you covered. With loan amounts ranging from ₹2,000 to ₹1,00,000 and flexible loan periods from 91 to 180 days, you can easily find a loan that suits your needs. The app also provides a transparent calculation of interest rates and processing fees, ensuring that you can make informed decisions. With the Loan Guide App, getting a loan has never been easier. Say goodbye to long queues and complex paperwork, as this app simplifies the entire process. The app is here to guide you through the loan process efficiently and effectively.

Features of Get Loan on Aadhar Card Guide:

⭐ Quick and Easy Loan Process: The Loan Guide App provides a convenient and hassle-free loan application process. With just a few simple steps, users can register, fill in their basic information, and submit their loan application.

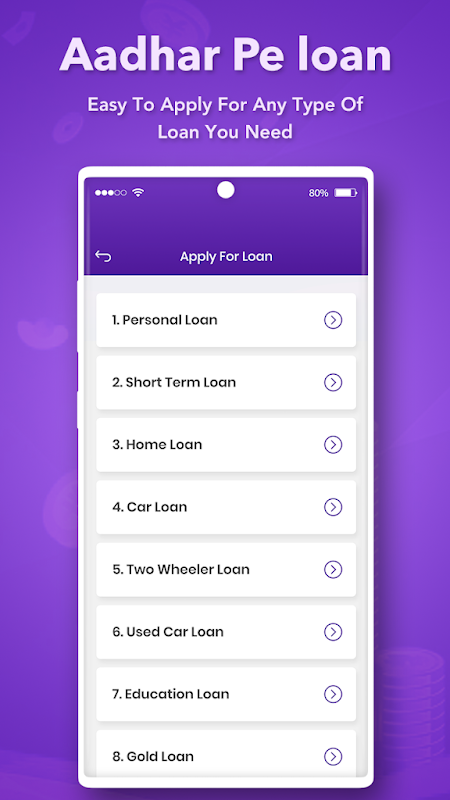

⭐ Flexible Loan Options: Whether you need a personal loan, home loan, education loan, credit card loan, business loan, gold loan, or car loan, the Loan Guide App offers a wide range of loan options to cater to diverse financial needs.

⭐ Low Interest Rates: The Loan Guide App offers loans with low interest rates, providing users with a favorable financial solution that won't burden their finances.

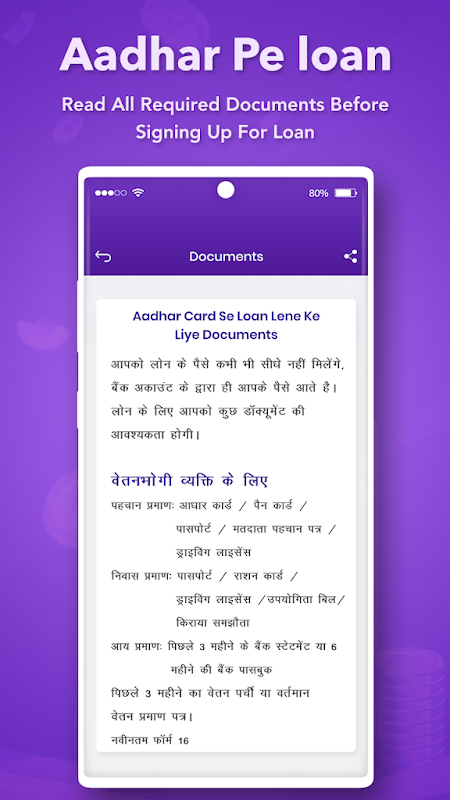

⭐ Minimal Documentation: Unlike traditional loan applications that require extensive documentation, the Loan Guide App simplifies the process by eliminating the need for excessive paperwork. Users can enjoy a streamlined application process without the hassle of gathering numerous documents.

FAQs:

⭐ Why should I choose a loan on Aadhar Card?

Choosing a loan on Aadhar Card offers several advantages, including high loan amounts, low interest rates, minimal documentation requirements, and a simplified application process. With its quality service, the Loan Guide App provides a convenient and efficient way to secure the funds you need.

⭐ Who is eligible for a loan on Aadhar Card?

To be eligible for a loan on Aadhar Card, you must be an Indian citizen between the ages of 18 and 45 and have a consistent monthly income.

⭐ How does the personal loan process work?

The personal loan process through the Loan Guide App is simple. After registering an account and submitting your application, you may receive a call for verification. The final application result will be displayed in the app, and you will receive an SMS notification if your loan is approved. The approved loan amount will then be disbursed to your account.

⭐ What information can I find on the Loan Guide App?

The Loan Guide App provides comprehensive information on various aspects of seeking a loan, including the easy steps to apply for a loan, the terms and conditions for online Aadhar loans, eligibility criteria, required documents, and the application process using Aadhar.

Conclusion:

With its quick and easy loan process, flexible loan options, high loan amounts, low interest rates, and minimal documentation requirements, the app provides an attractive solution for individuals seeking financial assistance. Whether you need a personal loan, home loan, education loan, or any other type of loan, Get Loan on Aadhar Card Guide is designed to simplify the lending process and provide users with a seamless experience. Download the app now and take advantage of its features to fulfill your financial needs efficiently and effectively.

- No virus

- No advertising

- User protection

Information

- File size: 10.00 M

- Language: English

- Latest Version: 1.0.6

- Requirements: Android

- Votes: 295

- Package ID: com.secandamadluynase.maduylnabijana

- Developer: Avizan finse

Screenshots

Explore More

We have compiled a selection of reliable and user-friendly mobile learning and educational apps for 2024. These apps offer rich learning materials and diverse course offerings, allowing users to select courses based on their individual needs. Check them out if you're interested!

Video Downloader

HelperPlace - Job for Helpers

Translator for All Languages

meditatorium

Biografi & Kisah Nabi Khidir

HiEdu Scientific Calculator

Promova: Fast Learn Education

MEGOGO: Live TV & movies

![Nickel [alpha] APK](https://image.gamespot.com.cn/upload/202412/01/dbf89Q0VELxgSWh.jpg)