Introduction

Introducing an essential tool for mortgage hunters, the Mortgage Calculator UK app is here to simplify the process and reveal the true cost of your mortgage deal. No more confusing jargon or misleading rates - this free app allows you to calculate the monthly payment before and after your deal ends, factor in overpayments and see the impact of rising interest rates. With helpful explanations along the way, even if you don't understand terms like amortization or APR, you'll gain a clear understanding of each number and how it affects you. Whether you're in the UK or not, this app is a must-have for anyone looking to navigate the mortgage market with ease.

Features of Mortgage Calculator UK:

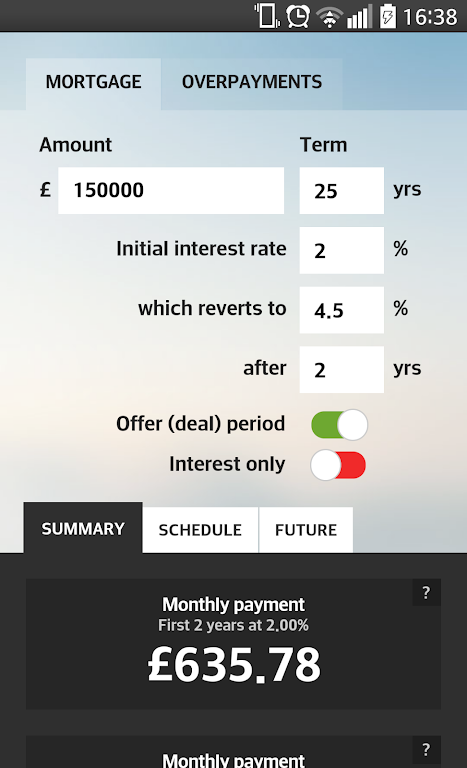

- Accurate and Transparent Mortgage Calculation: Mortgage Calculator UK is a user-friendly app that enables homebuyers to easily calculate the true cost of their mortgage deal in both the short and long term. It cuts through confusing jargon and misleading rates to provide accurate calculations and ensure transparency.

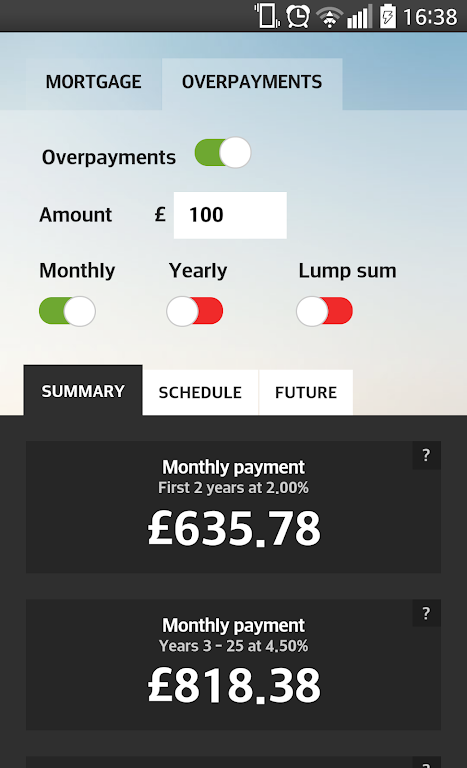

- Flexible Factors: This app offers the option to factor in various payment scenarios, including monthly, annual, or one-off overpayments. By customizing these factors, users can accurately plan for their financial future and make informed decisions based on realistic payment options.

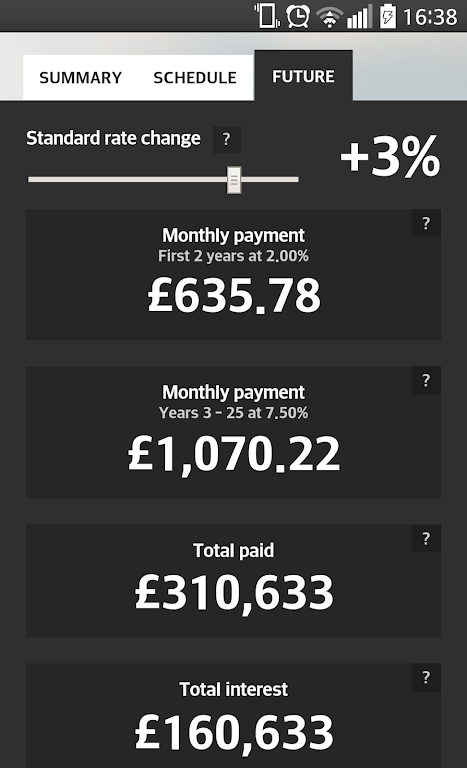

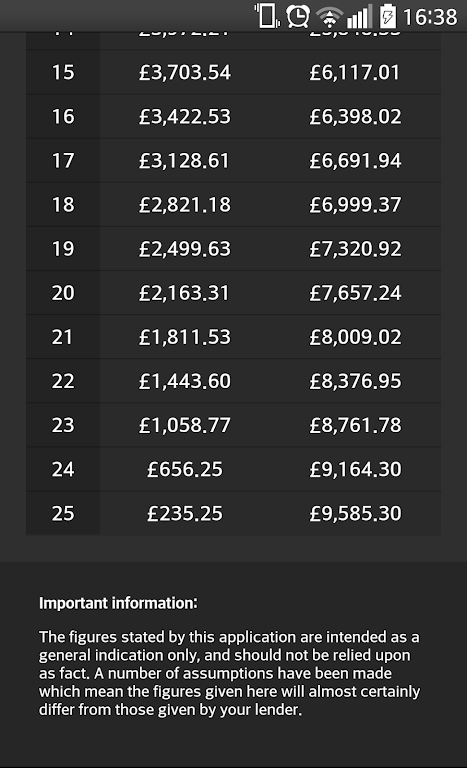

- Comprehensive Insights: Mortgage Calculator UK provides a wide range of valuable information beyond just the monthly payment. Users can see the potential impact of rising interest rates, understand interest-only payment options, calculate the time saved by making overpayments, and even determine the total cost per £1 borrowed.

- Educational Resources: Understanding mortgage terms like amortization and annual percentage rate (APR) can be challenging for some users. This app offers helpful explanations and definitions throughout the calculation process, ensuring that users comprehend what each number means and how it affects their mortgage.

Tips for Users:

- Explore Different Payment Scenarios: To make the most of Mortgage Calculator UK, try experimenting with different payment scenarios. Adjust the input for monthly, annual, or one-off overpayments to see how it affects the outcome, helping you determine the most suitable payment options for your financial situation.

- Utilize the 'Future' Slider: This app features a useful 'future' slider that allows users to visualize how changing interest rates could impact their mortgage after the initial offer period ends. By testing various interest rate scenarios, you can gain valuable insights and plan for potential changes, ensuring you are prepared for any future adjustments.

- Dive Into the Details: While the monthly payment is crucial, take advantage of the additional insights provided by Mortgage Calculator UK. Explore the impact of rising interest rates, understand the benefits of making overpayments, and analyze the total cost per £1 borrowed. This comprehensive approach will help you make informed decisions and plan effectively for your mortgage.

Conclusion:

With its accuracy, transparency, and user-friendly interface, this app provides an essential tool to calculate the true cost of mortgage deals. By offering flexible factors, comprehensive insights, and educational resources, Mortgage Calculator UK empowers users to make informed decisions about their mortgage payments. Take advantage of the playing tips provided to explore different payment scenarios, utilize the 'future' slider for long-term planning, and dive into the details to fully understand the financial implications of your mortgage. Download it today to simplify and optimize your mortgage experience.

- No virus

- No advertising

- User protection

Information

- File size: 3.80 M

- Language: English

- Latest Version: 0.0.6

- Requirements: Android

- Votes: 161

- Package ID: uk.co.jamesgrimwood.mortgageadvisor

- Developer: Grimwood

Screenshots

Explore More

We have compiled a selection of reliable and user-friendly mobile learning and educational apps for 2024. These apps offer rich learning materials and diverse course offerings, allowing users to select courses based on their individual needs. Check them out if you're interested!

Video Downloader

HelperPlace - Job for Helpers

Translator for All Languages

meditatorium

Biografi & Kisah Nabi Khidir

HiEdu Scientific Calculator

Promova: Fast Learn Education

MEGOGO: Live TV & movies