Introduction

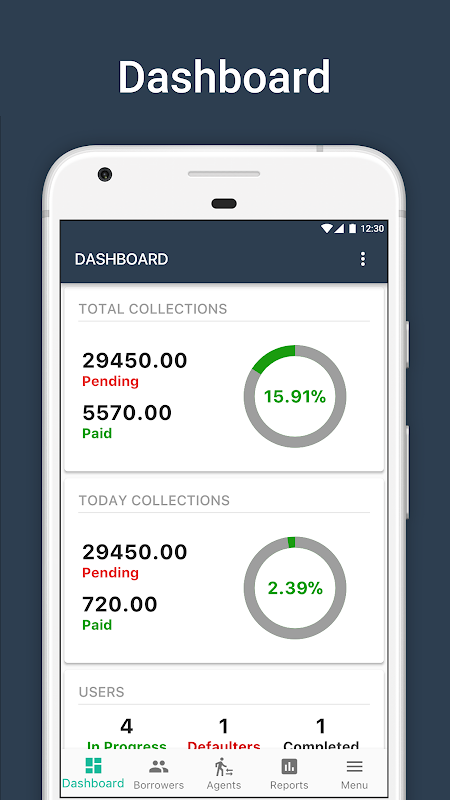

Introducing the Micro Finance app, a game-changer for small-scale finance firms and individuals in need of financial assistance. In today's digital age, managing finances can be a hassle, especially without proper accounting software. That's where our well-crafted and beautifully designed app comes in. With Micro Finance, users can bid farewell to their account books and go digital, simplifying the process of managing finances. Not only does the app provide a platform for money lenders and borrowers to connect and seek financial help, but it also offers features like online and offline mode, advanced security measures, personal settings for interest rates and installments, comprehensive accounting history, detailed reports, and support for multiple languages. Whether you're a money lender, borrower, or agent, the app has got you covered. Say goodbye to the complexities of managing financial affairs and start managing like a pro.

Features of Micro Finance:

> Efficient Accounting Software: Micro Finance provides a simple and efficient accounting software for small-scale finance firms. It eliminates the need for traditional account books and allows users to manage their finances like professionals.

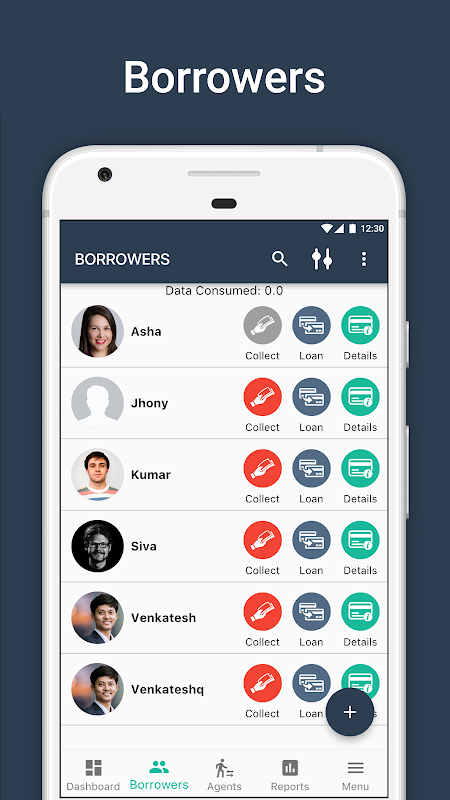

> Connectivity Between Money Lenders and Borrowers: The app serves as a platform for both money lenders and borrowers to connect with each other. Borrowers can easily find money lenders who can provide financial help and directly contact them through the app.

> Online and Offline Mode: The app works seamlessly, whether the device is connected to the internet or not. Users can access their financial data even without an internet connection, ensuring convenience and accessibility at all times.

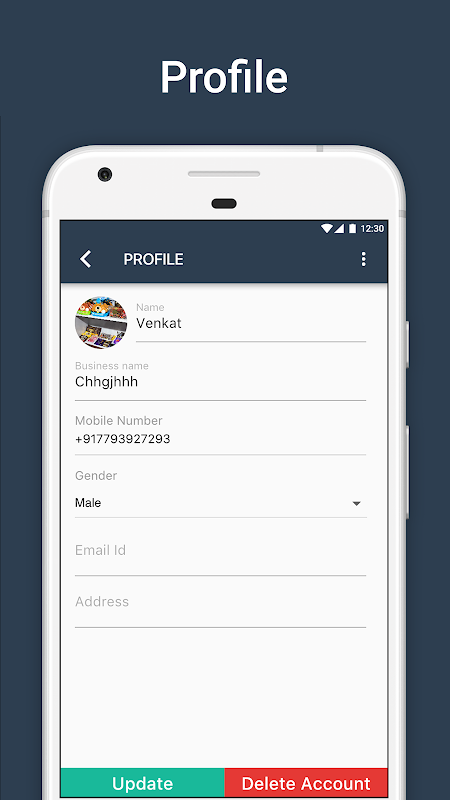

> Personalized Settings: Users can set their own default interest rate and the number of installments in the app's settings. It allows for customization and tailoring the app to fit the specific needs and preferences of the users.

Tips for Users:

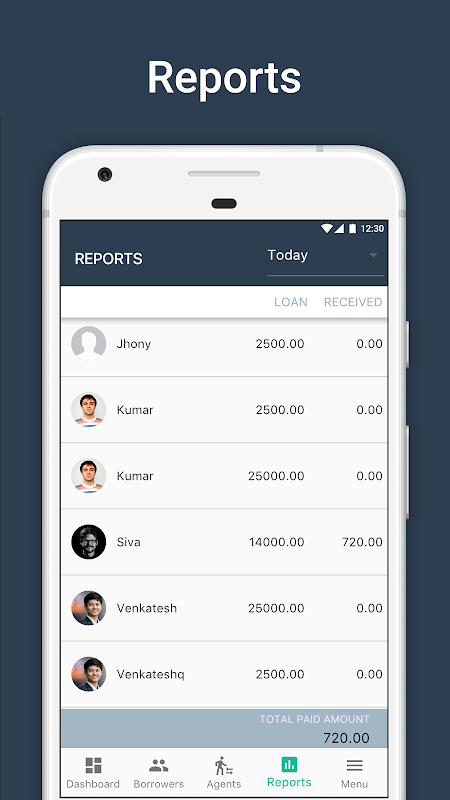

> Regularly Check Payment History: Users should regularly check the app's full accounting history feature to keep track of the payments made by borrowers towards their loans. This helps in calculating outstanding payments and remaining balances accurately.

> Utilize Reports for Better Financial Analysis: The app provides detailed reports on credits, debits, profit, and loss. Users should take advantage of these reports on a daily, weekly, monthly, or yearly basis to analyze their financial performance and make informed decisions.

> Make Use of Agents: Money lenders can add agents to the system who can collect money on their behalf. Users should utilize this feature to delegate the task of collecting payments and ease their workload.

Conclusion:

With its efficient accounting software, connectivity between money lenders and borrowers, and user-friendly features like online and offline mode and personalized settings, it simplifies the financial management process. By regularly checking payment history, utilizing reports for analysis, and making use of agents, users can effectively streamline their finance business and enhance their financial management capabilities. Download Micro Finance app today and experience the convenience and efficiency it brings to managing your financial transactions.

- No virus

- No advertising

- User protection

Information

- File size: 12.00 M

- Language: English

- Latest Version: 3.2.7

- Requirements: Android

- Votes: 287

- Package ID: com.prayuta.microfinance

- Developer: Prayuta

Screenshots

Explore More

Discover and download the latest system software of 2024 at high speed for free. Explore multidimensional rankings and references to help you choose the best system software. Rest assured, all software has undergone rigorous security checks and virus scans for your safety.

Lena Adaptive

Simple Shift - work schedule

Amazon Prime Video

Dumpster

WOT Mobile Security Protection

Sight Singing Pro

Anti Spy 4 Scanner & Spyware

Photo Background Change Editor