Introduction

FlexiLoans: Business Loans is a revolutionary app that aims to cater to the financial needs of micro, small, and medium-sized enterprises (MSMEs) in India. With their expertise in lending, they provide quick and hassle-free access to business loans for various purposes such as working capital management, expansion plans, equipment financing, and more. Unlike traditional banks that have stringent eligibility criteria and lengthy approval processes, FlexiLoans understands the struggles of small business owners and aims to bridge the financing gap. So, if you're a small business owner looking for financial support to grow and succeed, FlexiLoans is the app for you.

Features of FlexiLoans: Business Loans:

- Quick and Hassle-Free Access to Funds: FlexiLoans understands that small business owners often face challenges in obtaining loans from traditional banks. That's why they prioritize providing quick and hassle-free access to funds, ensuring that businesses can get the financing they need without unnecessary delays or complicated approval processes.

- Diverse Range of Financial Solutions: FlexiLoans offers a wide range of financial solutions to meet the diverse needs of businesses. Whether it's working capital management, expansion plans, purchasing inventory, or equipment financing, they have tailored loan options to suit different requirements and help businesses thrive.

- Attractive Lending Rates: FlexiLoans provides loans at attractive lending rates, with an annual annual percentage rate (APR) starting from 12%. This ensures that businesses can access financing at competitive rates, helping them save on interest costs and improve their financial standing.

- Customized Loans for Various Industries: FlexiLoans understands that different industries have unique financial needs. That's why they offer customized loans for retailers, traders, restaurants, online sellers, and more. This personalized approach ensures that businesses can get the specific financing they require to support their growth and success.

Tips for Users:

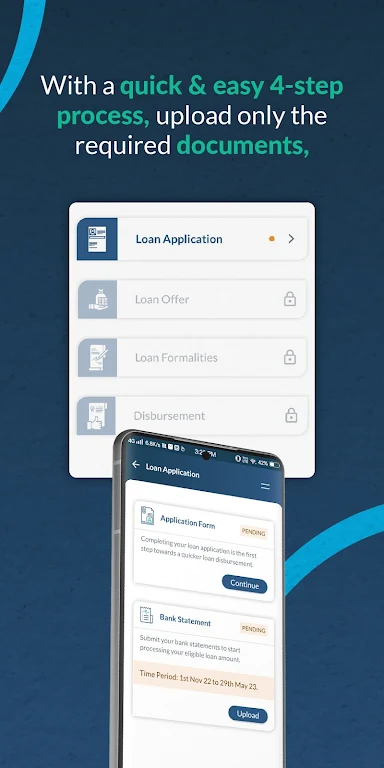

- Explore the Loan Options: Take the time to explore the different loan options available on the app. Assess your business's needs and choose the loan type that best fits your requirements, whether it's a term loan, invoice discounting, line of credit, or merchant cash advance.

- Pay Attention to the Terms and Repayment Options: Before taking out a loan, carefully review the terms and repayment options provided by FlexiLoans. Understand the interest rates, repayment tenure, and flexible repayment terms available. This will enable you to make an informed decision and ensure smooth repayment.

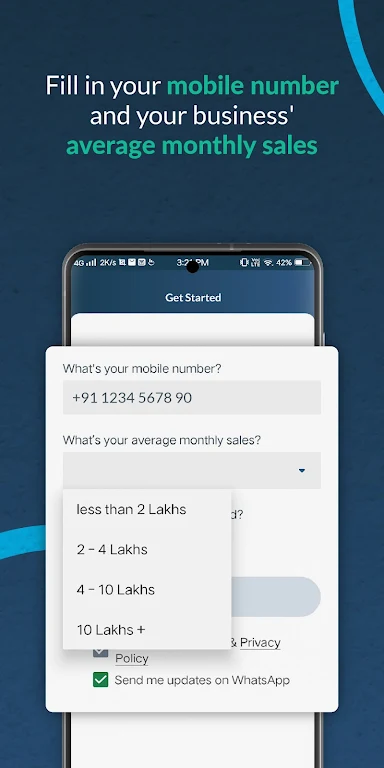

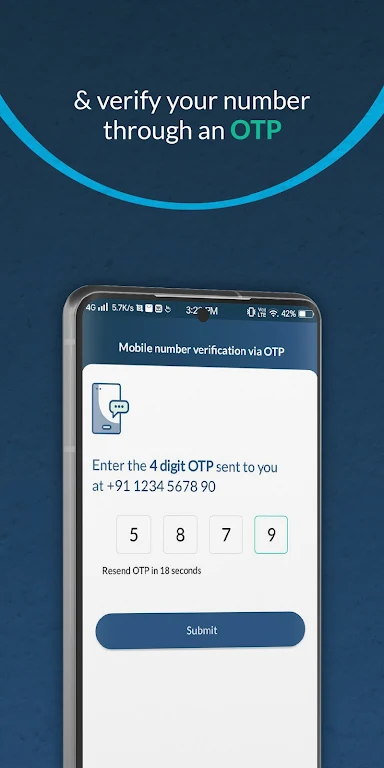

- Upload Documents Electronically: The app offers a seamless digital loan application process. Utilize this convenience by uploading the required documentation electronically. Ensure that you have your PAN card number, a digital photocopy of your Aadhaar card, and a selfie ready to complete the application process quickly.

Conclusion:

By exploring the loan options, paying attention to terms and repayment options, and utilizing the app's digital features, businesses can make the most of FlexiLoans' services. With their focus on providing flexible and tailored financial solutions, FlexiLoans: Business Loans aims to support the growth and success of MSMEs in India. Download the app today and experience a seamless and efficient loan application process.

- No virus

- No advertising

- User protection

Information

- File size: 28.80 M

- Language: English

- Latest Version: 82.4.22

- Requirements: Android

- Votes: 133

- Package ID: com.flexiloan

- Developer: Flexiloans.com

Screenshots

Explore More

Explore the Latest Free Downloads of Top Photo Apps in 2024, Featuring Multi-Dimensional App Rankings and Recommendations for the Best Photo Applications. All apps are virus-free, safe and secure for your peace of mind.

Kleinanzeigen - without eBay

Haylou Fun

DSLR HD Camera

Meme Generator PRO

Moments - Countdown widget

LockMyPix Safe Photo Vault

Text Snap

Google Keep - Notes and Lists