Introduction

IndiaMoneyMart - P2P Lending is a leading Peer-To-Peer (P2P) lending platform in India. With its registration by the Reserve Bank of India, it offers investors attractive returns and borrowers affordable loans. The platform connects creditworthy small business borrowers directly with investors, creating a marketplace for lending. The strength of the app's fintech platform, combined with its nationwide presence and thorough borrower evaluation, allows investors to earn high returns. Join it now to earn high returns while making a positive impact on people's lives through debt investment.

Features of IndiaMoneyMart - P2P Lending:

- High Returns: It offers attractive returns to lenders on their debt investments. By investing in creditworthy small business borrowers, lenders have the opportunity to earn high returns on the platform.

- Affordable Loans: Borrowers on the app can avail of affordable loans for productive business use. With a range of loan amounts and reasonable interest rates, borrowers can access the funds they need to grow their businesses.

- Direct Assessment: IndiaMoneyMart - P2P Lending believes in direct sourcing and in-depth credit assessment. By personally meeting with borrowers and evaluating their creditworthiness, the platform ensures that lenders are connected to prime borrowers.

- Reinvestment Options: Lenders have the option to reinvest their funds on it, allowing them to take advantage of the power of compounding. By continuously reinvesting their returns, lenders can maximize their investment growth.

Tips for Users:

- Diversify Your Portfolio: To minimize risk, consider splitting your funds into multiple loans on it. By diversifying your portfolio, you can spread out your investment across different borrowers and industries.

- Utilize Online Tracking: Take advantage of the app's precise online tracking feature. This allows you to monitor the performance of your loans and make informed investment decisions.

- Take Advantage of Support: IndiaMoneyMart - P2P Lending offers complete relationship support to lenders. They provide calling, email, and other forms of assistance to help you make the most of your investment experience.

Conclusion:

With its strong fintech platform and meticulous borrower evaluation process, the platform ensures that investors can earn high returns while minimizing risk. By directly sourcing creditworthy small business borrowers and providing in-person assessments, IndiaMoneyMart - P2P Lending connects lenders with prime borrowers. With features like reinvestment options and support from the platform, lenders can make the most of their investment on the app. Whether you are looking to earn high returns or access affordable loans, it provides a reliable and efficient platform for P2P lending.

- No virus

- No advertising

- User protection

Information

- File size: 13.70 M

- Language: English

- Latest Version: 64.0.0

- Requirements: Android

- Votes: 147

- Package ID: com.fv.imm

- Developer: Fair Vinimay Services Pvt Ltd

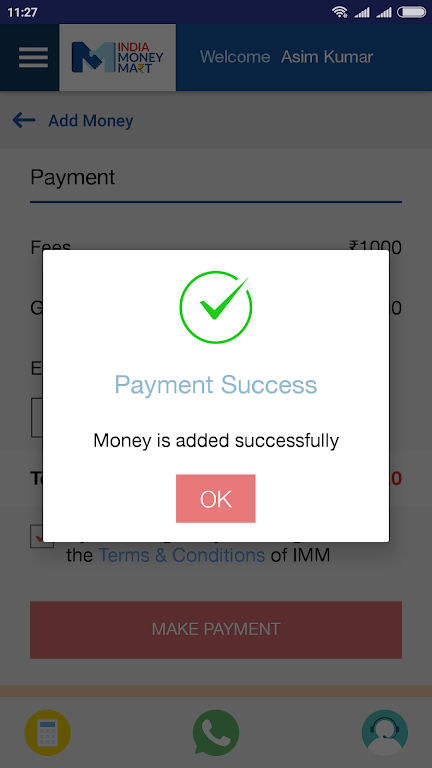

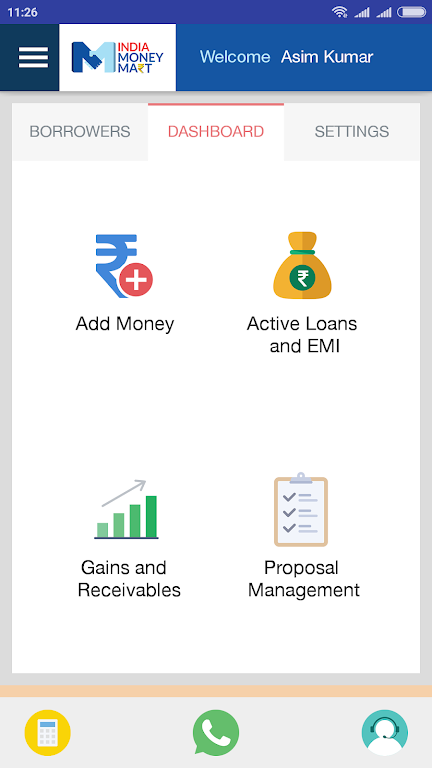

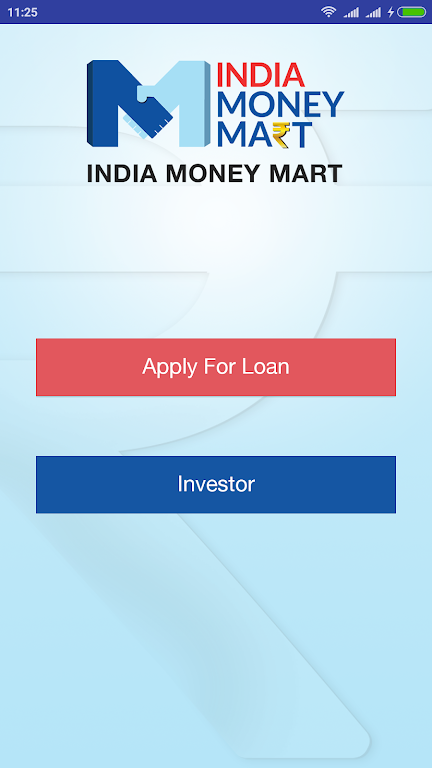

Screenshots

Explore More

Mobile reading is becoming more and more fashionable now, not only because it is very convenient to read, but more importantly because it is very rich in content and can read almost all the books you want to read. Which mobile reading software is better? We have carefully compiled mobile reading software rankings, free reading software and so on. Now, we recommend the most popular free e-book reading software to everyone.

Magnifier Plus with Flashlight

All Document Reader and Viewer

Universal TV Remote Control

Wizdom

RecycleMaster: Recovery File

The Clock

INKredible PRO

Greetz - kaarten en cadeaus